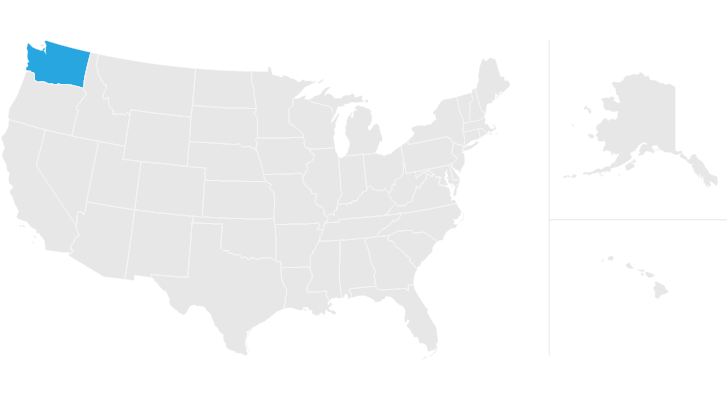

capital gains tax proposal washington state

The bill is part of a multi-year push by the legislature to rebalance a state tax. The governors proposed tax on capital gains sets a higher rate at 9 and taxes more people by setting the threshold for gains.

Team Rera Wishes You A Happy Holi Happy Holi Color Festival Happy

Of course all the states Office of Financial Management can do is assume that capital gains will increase every year whereas in practice capital gains are exceedingly volatile.

. Description This proposal would tax individuals for the sale or exchange of capital assets they have held for more than one year unless an exemption applies. How much will the state collect under the tax. This proposal impacts approximately 58000 taxpayers and will impact the state general fund in the following ways.

Mercier says theres no doubt that this is an income tax and that pretending otherwise is disingenuous not that thats a new feature regarding capital gains tax proposal in Washington state. SB 5096 would impose a 9 income tax on capital gains in Washington state. For example if your annual gains are 249999 no additional tax is incurred.

While the appeal is pending the Department will continue to provide guidance to the public regarding the tax as a. Senate Bill 5096 sponsored by Sen. To see what Gov.

Inslee proposed in his 2021-23 budget see Gov. 5096 which was signed by Governor Inslee on May 4 2021. This information relates to a capital gains tax as proposed in 2018.

Inslees 21-23 capital gains tax proposal QA. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. If we accept the states argument that its an excise tax then its probably an unconstitutional one because it fails to meet the nexus requirements established in cases like Complete Auto Transit.

Washingtons capital gains tax proposal was passed out of the state Senate in early March and is now moving through the House. Separately the Democratic governor also released proposed capital construction and transportation budgets. This tax only applies to individuals.

If theyre 250050 you incur a 7 state tax on that extra 50. 2 days agoThe proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether. Washington state Gov.

Senate Bill 5096 levies a 7 tax on Washington residents annual long-term capital gains exceeding 250000. Timber A taxpayer who sells or cuts timber and elects to treat the activity as a capital gain for federal tax purposes under Section 631a or b of the Internal Revenue Code is exempt from the proposed Washington capital gains tax. 221 million is in his.

OLYMPIA Earlier today Gov. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

Tech workers business owners public policy advocates and private citizens weighed in this week in favor of and against a proposed capital gains tax in Washington state. Washington Enacts New Capital Gains Tax for 2022 and Beyond. The tax measures are contained in the governors two-year 576 billion operating budget proposal released Thursday in advance of the 2021 Legislative session.

June Robinson D-Everett enacts a capital gains excise tax to fund the expansion and affordability of child care early learning and the states paramount duty to provide an education for the. Under the unusual dynamics of the COVID-19. The realization of capital gains slid 71 percent between 2007 and 2009 55 percent in 1987 and 46 percent in 2001.

Yes capital gains on real estate are taxable under the federal income tax. FOR IMMEDIATE RELEASE. Especially alongside proposed federal capital gains tax rate increases.

2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000. Barring any legal challenges the new. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid.

CLAs state and local tax team can help you evaluate and plan for Washington capital gains tax impacts. The new tax would affect an estimated 58000. This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023.

New state tax proposals examined by Jason Mercie r. The State has appealed the ruling to the Washington Supreme Court. It taxes out-of-state earnings and out-of-state activity.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. To see what Gov. This is not the great recession - WA revenues still growing every year.

Inslee proposed in his 2021-23 budget see Gov. Jay Inslee on Thursday unveiled a budget proposal for 576 billion in general fund spending and a capital gains tax for the 2021-23 biennium. Per-Capita Inflation adjusted state spending has more than doubled since 1970s.

On 4 May 2021 Governor Inslee signed Engrossed Substitute Senate Bill 5096 the Act establishing a state-level tax on long-term capital gains for Washingtonians beginning 1 January 2022. There are significant exclusions which prevent the tax from falling on most sellers the first 250000 in gains are exempt for single filers or 500000 for joint filers but beyond the exclusion amount the net of gains from real estate are taxedas capital gains. Ad Real Estate Estate Planning Financial Aid Affidavits and more.

Washington State Capital Gains Tax. This information relates to a capital gains tax as proposed in 2018. Exempt from the proposed Washington capital gains tax.

Washingtons capital gains tax is designed as a direct tax not an indirect one. No capital gains tax currently exists in Washington at the state or local level. Washington has worst local taxes in nation The money collected from the capital gains tax will reduce taxes for 300000 small businesses reduce property taxes paid by.

Inslees 21-23 capital gains tax proposal QA. The new law will take effect January 1 2022. Prepared by the Department of Revenue Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by.

A warning from France on wealth taxes. Jay Inslee signed a critical piece of tax reform legislation. Continue Reading Governor Dusts Off Washington Capital Gains Tax Idea Proposes Insurance.

The Mira Bhayander Municipal Corporation In The Indian State Of Maharashtra Lodged A Complaint With The Police On 23 Kutipan Hari Rabu Kerja Pajak Penghasilan

Moving Toward More Equitable State Tax Systems Itep

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Vqt Bell The Cat Job Creation

Inheritance Tax Definition Taxedu Glossary Terms

How High Are Capital Gains Taxes In Your State Tax Foundation

Where Upper Middle Class People Are Moving Upper Middle Class Middle Class Financial Advice

Does Your State Have An Individual Alternative Minimum Tax Amt

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Benefits Of Using Rust Programming Language In 2022 Rust Programming Language Programming Languages Language

Washington Estate Tax Everything You Need To Know Smartasset

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

New State By State Analysis Of Gop Tax Hike Plan Crushing Tax Increases For Families Across America Speaker Nancy Pelosi

Don T Die In Nebraska How The County Inheritance Tax Works

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Liqour Taxes How High Are Distilled Spirits Taxes In Your State